Cost of Capital Formula: A Deep Dive for Startups and SaaS Companies

Understanding the cost of capital is crucial for startups, especially in the Software as a Service (SaaS) industry, to achieve their financial goals and secure funding. The cost of capital formula calculates the minimum return that projects must generate to satisfy investors and lenders. This formula comprises three components: cost of equity, cost of debt, and the risk-free rate. Startups typically secure funding through debt and equity, and a weighted average cost of capital (WACC) technique helps them measure the total costs associated with these sources while evaluating performance and growth.

WACC and Investment Decisions in SaaS Startups

WACC plays a pivotal role in discounted cash flow valuation methods, where it serves as the discount rate for a company's projected future cash flows. Startups with lower WACC rates stand a greater chance of securing investment funds from lenders or venture capitalists. This is particularly crucial for SaaS companies that often require substantial upfront investment before achieving profitability.

B2B SaaS Pricing Models: A Key to Non Dilutive Capital

Effective pricing models are vital for SaaS companies. They not only complement and reinforce customer value delivery but also play a significant role in securing non dilutive capital. Non dilutive funding refers to capital obtained without giving away equity, an essential consideration for startups keen on maintaining control and ownership.

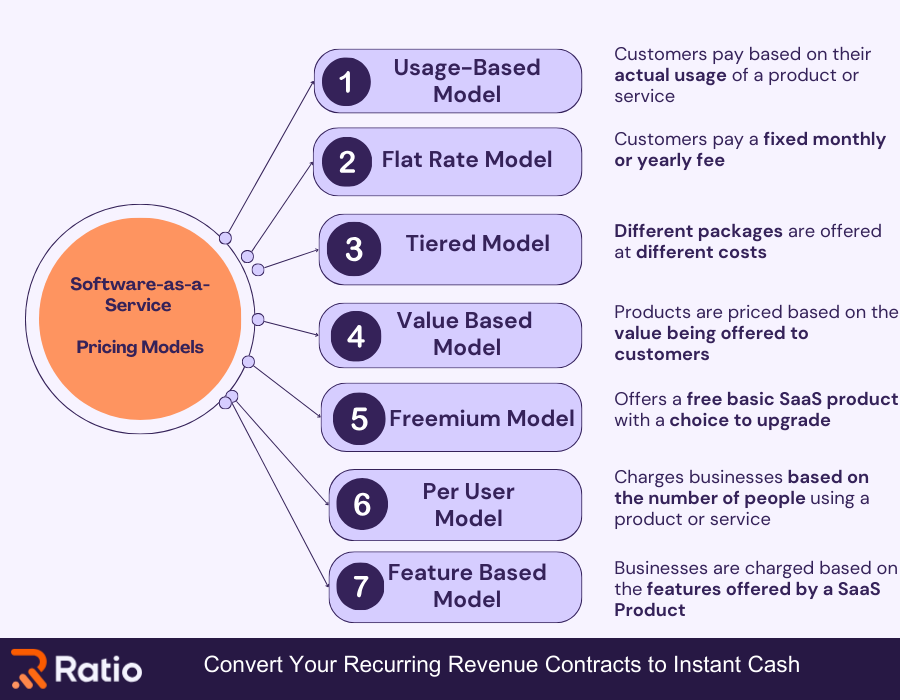

User-based pricing (active user pricing), where customers are charged based on the number of software users, can scale easily with demand and lead to predictable monthly revenue growth. B2B SaaS companies often employ several pricing models, such as competitor-based, value-based, flat-rate, and tiered pricing, to optimize their financial health and attract non dilutive capital.

Sonal Puri, a board member and former CEO at Webscale, highlights the importance of strategic partnerships and pricing models: "Every SaaS company should partner with Ratio because it’s a true win-win situation – our customers get the terms and flexibility they need and we get the cash upfront without dilution and zero risk."

Leveraging Cloud Spending Trends for Optimized SaaS Pricing

According to Gartner, the global cloud infrastructure market is projected to reach $1 trillion by 2024, with Infrastructure as a Service (IaaS) experiencing the highest growth at 37%. This surge underlines the importance of cost optimization and strategic pricing for cloud companies' continued profitability. Startups must find a balance between revenue growth and cash flow breakeven, aiming for triple-digit revenue growth with less than a 1.2x burn ratio, and aligning their pricing strategies with projected cash flows and target burn rates.

Strategic Pricing as a Comprehensive Financial Tool

Selecting an ideal pricing model is a crucial part of financial planning for any startup. Cost-based pricing models use internal costs to set prices, calculated by measuring total product or service costs and adding a profit margin. Competitor-based pricing involves analyzing competitors' prices to establish their own. The WACC formula considers both debt and equity financing sources, measuring overall company financial health while evaluating potential new investments or acquisitions.

A well-thought-out pricing plan can be crucial to a startup's success, with research suggesting that even minor improvements to pricing can result in 12.77% higher profits. Therefore, startups should give pricing models equal consideration as other aspects of product development and marketing. Sufficient time and care in creating a pricing plan can lead to significant financial benefits, including access to non dilutive capital.

Understanding the cost of capital is crucial for startups, especially in the Software as a Service (SaaS) industry, to achieve their financial goals and secure funding. The cost of capital formula calculates the minimum return that projects must generate to satisfy investors and lenders. This formula comprises three components: cost of equity, cost of debt, and…

Recent Posts

- Beepothecary Expands Product Line with Innovative Honey Bee Cream and Propolis Solutions

- Beepothecary Expands Product Line with Innovative Honey Bee Cream and Propolis Solutions

- Arthur Murray Dance Studio Brings World-Class Dance Lessons to Morristown, NJ

- Revolutionizing Heating Solutions with Expert Oil to Gas Conversions

- Revolutionizing Digital Marketing for Long Island Businesses